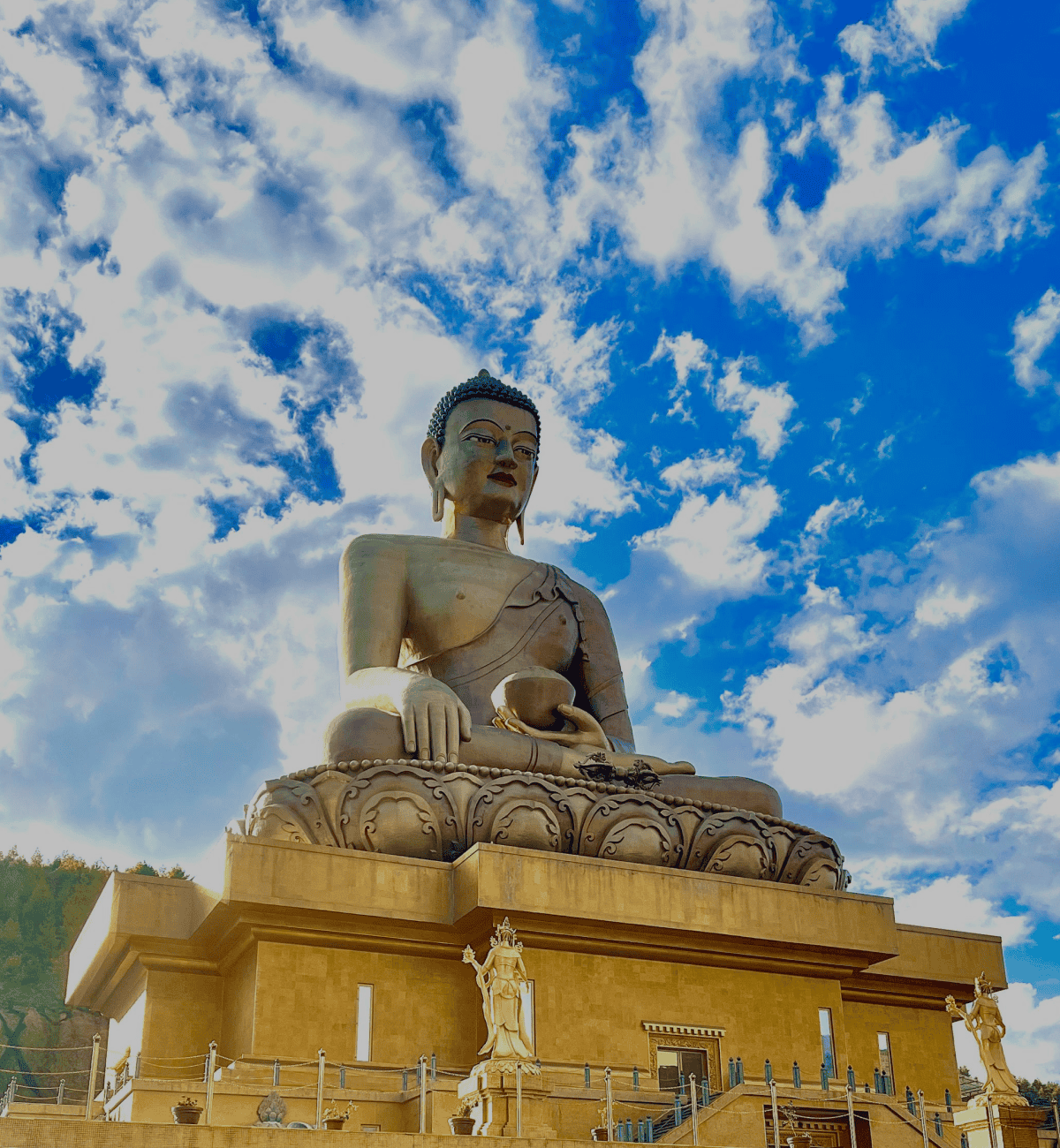

Gerab Nyed-Yon

The Investment arm of the Zhung Dratshang (Central Monastic Body of Bhutan)

The Latest From Our Blog

Explore More

The Royal Vision

Autonomous and rule-based entity operationalized under the Royal Charter;

Manage the Central Monastic Body's Assets and investments by professionals;

A company wholly owned by the Central Monastic Body and not transferable.

Our Journey thus far

Milestone Achievement of GNY

His Majesty The Druk Gyalpo granted the Royal Charter institutionalizing Gerab Nyed-Yon as an autonomous entity to manage the assets and investments of the Zhung Dratshang.

On the recommendation of the Advisory Panel, Dhuenmang Lhentshog appointed a seven membered Board of Directors including the CEO. Dasho Karma Yonten was appointed as the Founding Chairman of the Board.

GNY started its commercial operation from its corporate head office located at Simtokha, Thimphu . Mr. Sangay Dendup was appointed as the Founding CEO of the company.

Gerab Nyed-Yon Limited was registered under the Companies Act of Bhutan 2016.

Completed the first phase of handing-taking over of land and landed properties in the five core towns of Thimphu, Paro, Punakha, Wangdue Phodrang and Chukha.

The first Annual General Meeting of Gerab Nyed-Yon Limited was held at White Tara hotel. His Eminence Leytshog Lopen, His Eminence Tshogi Lopen and senior monks from Zhung Dratshang and Rabdeys representing the shareholder attended the meeting.

Completed transfer of ownership of shares held by Zhung Drasthang in other companies.

Coinciding with Zhabdrung Kurchoe, GNY launched its Enterprise Resource Planning (ERP) system developed by Zealous Systems and company website developed by Bhutan Spyders.

GNY has officially taken over the kuenselphodrang asset from Zhung Dratshang to facilitate its commercial development.

The Second Annual General Meeting of Gerab Nyed-Yon Limited was held at GNY conference hall. His Eminence Leytshog Lopen, His Eminence Yonten Lopen and senior monks from Zhung Dratshang and Rabdeys representing the shareholder attended the meeting.

The land ownership title transfer for 242 plots (Phase I property transfer of the five core towns in Thimphu, Paro, Punakha, Wangduephodrang, and Chukha) was completed, and Land Registration Certificate (Lag Thram) received by GNY.

Our Commitment

Profit generated from operations is channelled back to the Zhung Dratshang in the form of dividends.

We commit to provide a stable increment in dividents every year and at the same time grow the assets of the company.

A Message from the PM

Hear the Vision Behind Our Company

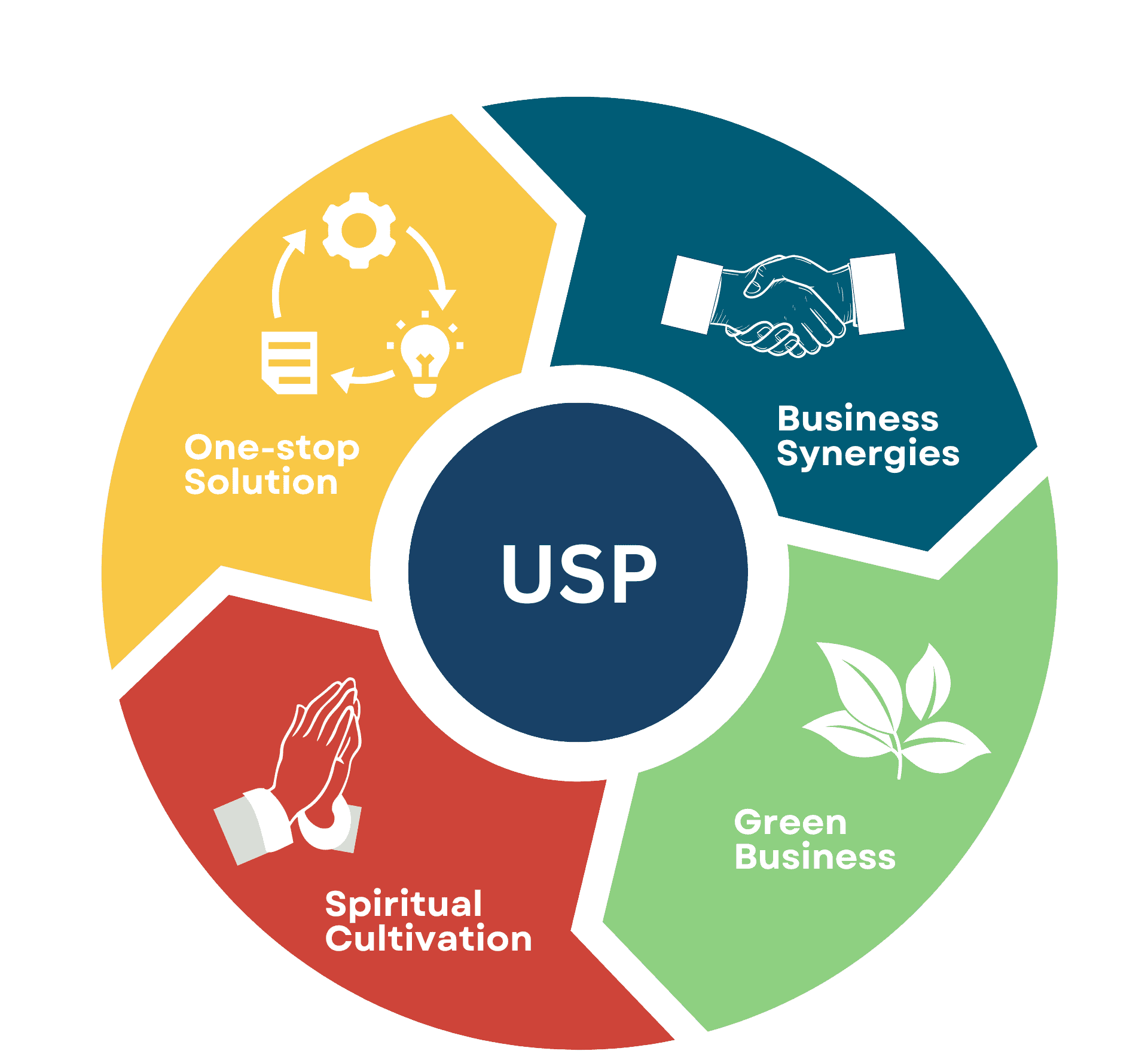

Unique Selling Point

GNY takes pride in the Unique Selling Points broadly grouped as follows:

Our Core Mandate

GNY engages in commercial and investment activities such as asset management, securities trading, and fundraising for investments across various asset classes within Bhutan and beyond, aiming for a diversified portfolio.